Jim Turner

Jim is the the SVP Market Development and Sales for Net2TV. Before joining Net2TV, Jim served as SVP of product strategy and business development for Canoe Ventures, LLC, a joint venture of the six largest cable operators in the United States. At Canoe, he worked to deliver advanced television products across interactive television, advanced VOD, addressable advertising, and data and analytic products.

Jim also served as vice president of product development at Synacor, the leading supplier of web services and digital media to the cable and telco industries. There he developed and implemented product strategy and management across content portals and web integration with DVR and VOD services. Before that, he was vice president of Digital Media at A&E Television Networks where he led the development and management of Internet, advanced television, and other digital media properties across A&E, The History Channel, The Biography Channel, and other brands. Earlier, he founded and served as president of AvitageMedia, a consulting and production company for advanced television, interactive advertising, Internet, broadband, and digital media.

Jim holds an MBA in marketing, and master’s and bachelor’s degrees in electrical engineering.

The Top Five Trends Affecting OTT in 2015

TRENDS and ANALYSIS by Jim Turner

The one trend that everyone in the OTT business can agree on is that there are too many trends in the OTT business! Shifts in consumer behavior, changes in rights and content agreements, technology advances and cost reductions, measurement of viewing on multiple platforms, demographic and generational changes, government regulations, and so much more are all playing into the rapid evolution and acceptance of OTT in the market.

However, in an attempt to get some non-scientific executive consensus on the top trends that are driving OTT over the next year, I moderated a panel at the recent OTT Executive Summit held in New York on June 17th entitled: “You Decide: The Top OTT Trends in 2015.” The session panel include four experts in the field: Chris Walters – CEO Encompass Digital Media, Martijn van Horssen – CEO 24i Media, Matt Smith – Chief Evangelist at Anvato, and James Norman – CEO Pilot.ly.

Prior to the session, the panel assembled a collection of quick data points about directions in the market and technology to stir the thinking of the audience, and also generated a list of 16 trends covering consumer behavior, monetization, content, technology and regulation for discussion by the panelists and the audience. After the initial introductions and presentation of the data points, each panelist discussed his view on the top trends and then we opened the conversation to the audience, as well as to the Trender Panel consisting of “laypeople” representing segments of the consumer market from teen to grandmother.

Following the lively conversation by the attendees, experts and Trenders, we asked for submission of votes on the trends, ranking them from top trend down to number 5, and allowed one write-in per person. The top trend on each ballot was given 5 votes, down to 1 vote for the number 5 trend, and the overall numbers were tallied.

We collected over 60 ballots from the room filled with leaders in all areas of the OTT world, and the results are quite interesting.

Starting at the bottom, the execs placed any impact of 4K/UHD coming into the market as the least influential trend on OTT in the next year. Close at the bottom of the results was also the impact of cable operators deploying wifi clouds to provide widespread access to high-speed non-cellular broadband connections out of the home.

The top write-ins were interestingly concerned with subtle issues around content rights, most importantly global content rights. During the discussion period, this point came up as content holders expressed their concerns about how they could effectively distribute and monetize their content outside of the domestic US market.

But now onto the Top 5! Starting from number 5:

- The continued proliferation of higher speed broadband. This trend garnered 8.8% of the weighted votes and includes the consolidation underway in the operator space that is much more about broadband services than video services.

Obviously stable high speed Internet is foundational for OTT’s success. The official number of homes in the US classified as “broadband homes” changed significantly this year as the FCC threw its weight behind getting download speeds up over 25Mbps by setting that speed as its new metric for classifying a household as having “broadband” service (up from 4Mbps previously). With that change, the percentage of US households the FCC recognizes as not having broadband increased from 6.3% of HHs to 19.6%.

As data services continue to be high margin offerings for broadband suppliers and drive consolidation and new competition, and they also push speeds higher to be certain that their product can meet the newly classified “broadband” services definition, OTT will certainly benefit.

Hovering just under this trend, however, were concerns about regulatory changes, usage charges and net neutrality issues in general.

- Programmers and content owners getting into direct-to-consumer OTT services. Capturing 9.6% of the votes, this trend was voiced in the conversations as a key to opening new opportunities for consumers to access niche content for which they will pay monthly fees, as well as for content owners to reach target audiences without having to gain position in an operator’s bundled line-up.

With services coming into the market seemingly weekly from sources ranging from premium cable networks to niche offerings from ad-supported networks to original vertical content owners seeking their viewers, this proliferation of new “networks” opens the door for the next generation of programming provider who re-bundles these many services into neat packages for consumers with single billing and customer management.

These new entries were also seen as drivers for continued experimentation with “skinny bundles” of content and ultimately a resetting of how consumers can buy packages of content that best meets their needs.

- Cord cutting. This entry captured the most #1 votes of any trend, but didn’t quite have broad enough support to gather more than 12.1% of the overall vote which landed it in third place.

There has been a lot of debate about whether or not cord-cutting has really had an impact yet, but the numbers coming from various research organization are showing that even if the impact hasn’t been felt yet, it is coming. Parks Associates reports that 7% of US households now have broadband and at least one OTT service (8.4M households) but no pay-tv service, and Digitalsmiths’ Q1 2015 Video Trends Report states that 7.9% of current pay-tv subscribers plan to drop their service in the next 6 months, with a whopping 32.4% saying “maybe” they will.

Given that consumer viewing of TV content continues to grow, if consumers do drop their pay-tv service, they will be turning to OTT services to fill the gap.

- Measurement of OTT for advertisers. With 13.9% of the vote, this trend had both a positive and negative side. Some expressed concerns that the fragmented state of viewer and ad measurement would hold back OTT’s growth, while others expressed optimism that measurement was coming together and would propel the market forward. In either case, the state of measurement of OTT was considered to be a significant driver of the market in the next year.

While many companies are working to achieve a viable and acceptable measurement of OTT viewing (and multi-screen viewing in general), there still is not a reliable and accountable metric for advertisers to embrace. On the good news front, alliances like Nielsen and Roku who have partnered to measure OTT video advertising are making some advertisers and agencies feel optimistic.

And coming in as the top trend for the next year…

- Ad dollars shifting to OTT. Getting the second highest number of #1 rankings and a total of 15.8% of the weighted votes, the movement of money from other sources (primarily TV budgets) into OTT was crowned as the most significant trend that would affect OTT in the next year.

In many ways, that is not really a surprise given that money follows eyeballs and eyeballs follow behavior. All the data and reports published in the last 18 months have shown a steady (and some say accelerating) decline in traditional TV watching with OTT services being the clearly expanding choice of viewers. Advertisers seeking the benefits of television advertising (engagement, viewablility, lack of fraud, etc.) can find that in long form OTT with a growing and younger skewing audience.

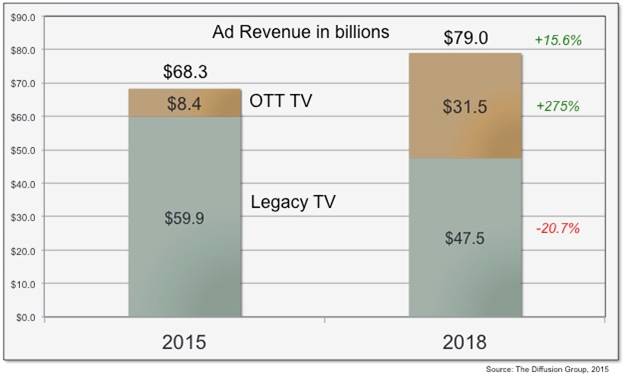

The Diffusion Group projects that over the next few years, OTT TV will take a huge share of “television” advertising as summarized below:

TDG says that by 2020, legacy TV and OTT TV advertising will essentially be indistinguishable to an advertiser. According to Alan Wolk, senior analyst at TDG:

“OTT advertising is still lumped in with YouTube videos and ads on sites that have video. By 2020, give or take, there will be no distinction between OTT and TV buying. If I’m Kraft, I will buy women 18 to 25 who are watching ‘Scandal,’ and that ad will show up through OTT or set-top boxes. They’ll be bought and sold together.”

Coming in as the top trend as voted by our 60 executives, this single driver actually ties the top three (if not all 5) trends together. As viewers move away from traditional “legacy” television through cord cutting and other behavioral changes, measurement will have to catch up and reach an acceptable standard which will provide a smoother runway for advertisers to move money to where the viewers are.

Will these be the big trends for 2015? Place your bets and let’s watch together.

...money follows eyeballs and eyeballs follow behavior. All the data and reports published in the last 18 months have shown a steady (and some say accelerating) decline in traditional TV watching with OTT services being the clearly expanding choice of viewers.